The Latin American market has become a major opportunity for operators looking to scale and work with long-term vision.

The industry is at a turning point: rapid growth, evolving regulatory frameworks, and a large base of active users. Our latest report covers everything from market analysis and the leading countries to regulatory challenges and strategic outlooks.

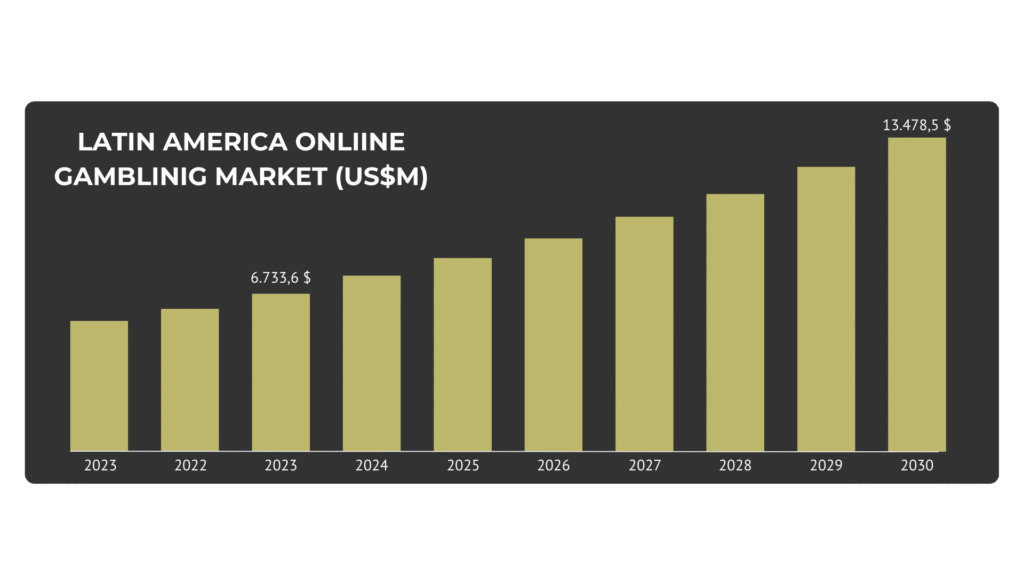

Market Growth: LATAM Is No Longer a Promise — It’s a Reality

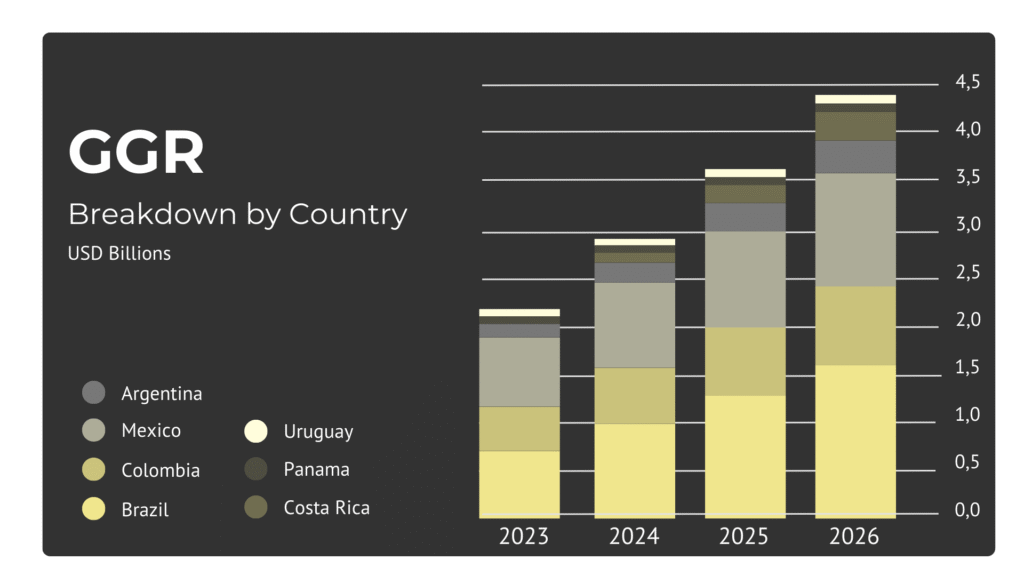

The iGaming market in LATAM is being driven by a combination of macroeconomic, technological, and regulatory factors that have accelerated its evolution. The global Gambling GGR has grown from USD 1.3 trillion in 2020 to USD 3.4 trillion in 2025.

Brazil leads the region with more than 100 million players. In 2023 and 2024, regulatory packages were implemented to establish clear conditions for sports betting. The evolution of GGR by country is striking.

LATAM has more than 670 million inhabitants, with the predominant iGaming audience being men between 18 and 35 years old. Additionally:

- More than 70% of the population owns a smartphone

- The average deposit ranges between $30 and $40, reaching $100 in Chile

- Local payment methods play a crucial role

Country Breakdown: Colombia, Chile, Mexico, Argentina, Peru & Brazil

Each country operates under its own rules; there is no unified regulatory framework representing LATAM. This forces operators to treat each jurisdiction as an individual market.

Brazil

- By 2029, online casino revenues are expected to reach USD 3.7 billion.

- The highest concetration of users is found in the three southernmost states of Brazil: Sao Paulo, Rio Grande do Sul, Minas Gerais.

Peru

- The market attracts more than 150 natioinal and international operators and generates an annual volume of USD 2.5 billion.

- 18% of Peruvians place bets occasionally each week, and 37% have gambled at least once.

- With approximately 5 million active players out of 24 million adults, penetration exceeds 20%.

- The online market is expected to grow at a compound annual rate (CAGR 2024-2028) of 6,4%

Argentina

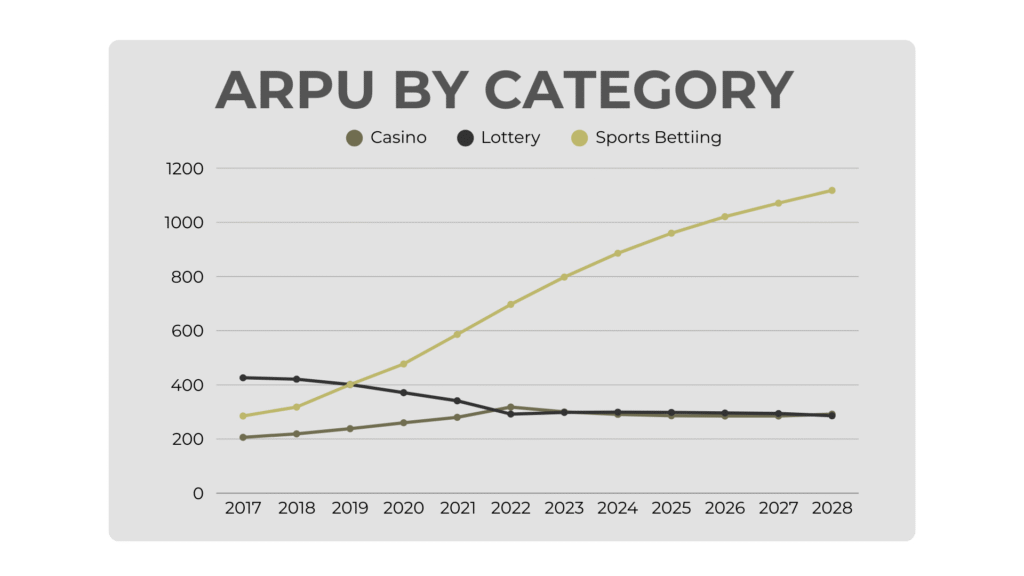

- Sports betting represents 47.3% of players, followed by lottery (41.8%), online slots (29.1%), and card games (18.2%)

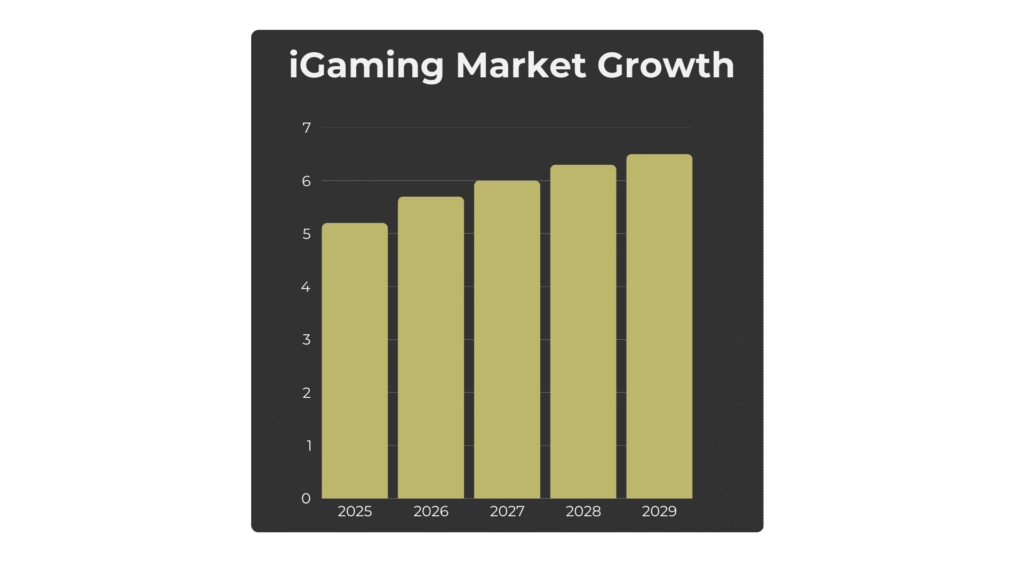

- The iGaming market is expected to experience a compound annual growth rate (CAGR 2025-2029) of 4.49%, resulting in a projected market size of USD 6.6 billion by 2029.

- From a regulatory standpoint, they operate under a decentralized, province-based model, where each jurisdiction designs its own system and tax structure.

Mexico

- Market size of $2.7 billion in 2024

- Compund annual growth rate (CAGR 2025-2030) of 15.03%

- The most typical games are: Casion (30%), Lotteery (15%), Sporrts betting (49%), others (6%)

- No new licenses are being issued: the only way to enter the market is by acquiring or partnering with an existing license holder.

Chiile

- The online industry generate between USD 130 and 170 million in revenue

- Varios studies iindicate that after regulation, the online gamblinig market is likely to grow at a compound annual rate (CAGR) of 9.27%, reaching USD 669.7 million by 2027.

- Key operators include Coldbet, Betsson, 1xBet, 22Bet, Stake and 1Win

- The online sector lacks regulation; companies do not pay local taxes, although a reform long awaited by the market is already underway.

Colombia

- 82% of Colombians àrticipate in gambling activities, reflecting a high level of engagement, with projected revenues of USD 2 billion by 2026

Future Outlook

The market is projected to grow exponentially through 2030, surpassing $13 billion in GGR. All data points to the same conclusion: sports betting is the region’s largest and fastest-growing vertical.

Local payment methods play a crucial role across LATAM. Solutions such as Brazil’s PIX, digital wallets, and instant transfers will become key differentiators.

We also observe a strong social component in land-based gaming, meaning that strategies capable of integrating both worlds will significantly enhance user retention. This must be paired with advanced personalization systems that enable dynamic promotions and precise user segmentation to compete with major brands.

The Importance of Having a Robust and Scalable Platform

The report makes it clear that operators looking to enter or scale in the region will need:

- A robust infrastructure capable of handling massive traffic spikes with zero downtime

- Fast integrations with local payment method providers

- Regulatory adaptability, with monitoring and the ability to implement changes quickly and efficiently

- Data-driven personalization, intelligent automation, and advanced segmentation

- 24/7 technical support—a repeatedly mentioned necessity among LATAM operators

If you want to scale without limits and rely on stable technology to compete in this highly attractive region, don’t hesitate to contact us.

CRMPAM – The quiet power behind your wildest traffic.