The iGaming market in Asia has, for decades, been one of the most attractive, and at the same time, one of the least transparent markets worldwide. This is largely due to its enormous potential in terms of user volume and accelerated growth, combined with significant barriers such as regulatory complexity and strong fragmentation between countries.

Even so, market data continues to position this continent not merely as a future promise, but as a current driver of global growth. In this article, we analyze the reasons behind this: market expansion and global weight, digital penetration and user behavior, the regions with the greatest potential, the critical role of regulation, and the substantial differences between countries.

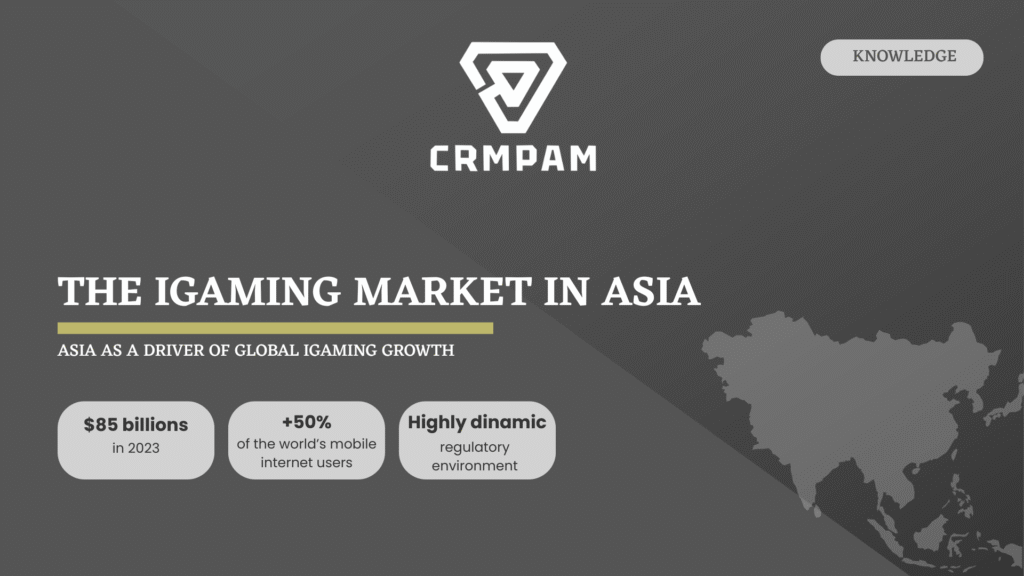

Asia as a driver of global iGaming growth

The iGaming market in this continent has grown steadily in recent years, surpassing $85 billion in 2023, compared to approximately $70 billion in 2022 (according to Statista and H2 Gambling Capital).

Within this context, the Asia-Pacific market has consolidated its position as one of the regions with the greatest weight, and above all, the fastest growth rate in the global landscape. According to estimates by Research and Markets, the online market in Asia-Pacific reached an approximate value of $35.9 billion in 2023, with a projected compound annual growth rate (CAGR) exceeding 10%.

Compared to other markets, its growth stands out not only for its volume, but also for its ability to integrate new users and expand its revenue base. For example, the European market may be considered more “mature,” but with more moderate growth. In Latin America, while growth rates are high, they are based on a smaller revenue foundation.

Digital users and mobile penetration

Another structural factor explaining the rise of iGaming in Asia is the continent’s strong digital foundation.

Asia accounts for more than 50% of the world’s mobile internet users. Moreover, in countries such as India, Vietnam, Indonesia, and the Philippines, internet access occurs primarily via mobile devices, making the region clearly mobile-first (DataReportal, 2024).

According to GSMA, smartphone penetration in the Asia-Pacific market is expected to exceed 75% in 2025, and more than 90% of digital time is consumed on mobile devices. For the iGaming sector, these figures translate into: Users who prefer fast games and short sessions, the need for platforms optimized for mobile traffic peaks, greater adoption of digital wallets over traditional card payments, and an increased sensitivity to overall mobile experience.

A Highly Heterogeneous Market: Key Regions

The region is composed of markets with very different dynamics, both in regulatory terms and in user behavior. Three key regions illustrate these differences: India, Japan, and Southeast Asia.

Southeast Asia: Accelerated growth and high fragmentation

This is one of the areas with the highest growth rates, outperforming the regional average in online gaming metrics. Countries such as the Philippines, Vietnam, and Thailand stand out.

The Philippines has established itself as an operational hub, thanks to a more advanced regulatory framework for certain online gaming licenses issued by Philippine Amusement and Gaming Corporation (PAGCOR). However, despite this relative openness, fragmentation remains significant across the region, requiring operators to adopt highly flexible strategies.

India: Massive volume and long-term potential

India represents one of the largest potential markets in the world. In 2024, the online gaming and betting market was estimated at $6.9 billion, with projections placing it above $16.8 billion by 2033, according to Statista and Research and Markets.

However, regulatory complexity and decentralization, combined with significant differences between states, substantially increase operational challenges.

Japan: Stability, technology, and strict regulation

Japan stands out for its technological sophistication. Despite strict restrictions on traditional online casinos and private betting, the country’s digital gaming market was estimated at $8.1 billion in 2024 (Statista).

While growth is more moderate, it is supported by strong purchasing power and highly advanced technological infrastructure. For many operators, Japan represents a long-term strategic bet rather than a rapid expansion market.

Regulation: The region’s greatest challenge

Regulation in this market cannot be reduced to a simple “legal” versus “illegal” map. It is an extremely fragmented, dynamic, and constantly evolving environment. Unlike more mature regions such as Europe, Asia lacks a uniform standard; each jurisdiction follows its own rules, which can change with little predictability.

For example, the Philippines has been one of the most open and structured Asian markets. Since the early 2000s, the country allowed the operation of Philippine Offshore Gaming Operators (POGOs), which provided betting services to foreign markets, particularly China. However, in 2023, the government reversed its position and declared the POGO regime illegal. At the same time, the country continues to regulate online gaming through licenses issued by Philippine Amusement and Gaming Corporation and other authorities since 2022.

In India, the Promotion and Regulation of Online Gaming Act was approved in 2025, an initiative aimed at establishing a national legal framework for iGaming and online gaming, including licensing, user protection, and advertising rules.

In Japan, although certain forms of betting are permitted (such as official lotteries or state-managed sports betting), traditional iGaming remains largely prohibited, with very limited licenses granted for land-based casinos intended for foreign tourists.

A clear case of total prohibition is China, where all forms of online betting and casinos are strictly banned. The only exception is state-controlled official lotteries, which operate under strict regulations and with limited public participation.

Conclusion: Asia as a strategic opportunity

Rather than viewing Asia as a barrier, it should be understood as a competitive environment where complex regulation defines who can enter, how, and under which business model. Markets with more defined regulatory frameworks, such as the Philippines, or potentially India, offer substantial opportunities. Meanwhile, highly restrictive markets like China present greater legal risk than opportunity.

For operators, the ability to adapt to multiple regulatory frameworks is essential, alongside significant investment in compliance, scalable architectures, and proactive legal management.

CRMPAM – The quiet power behind your wildest traffic